First-Time Buyer Statistics UK 2023

Propertyable’s polling, survey, and data analysis of recent trends have provided a comprehensive breakdown of the UK’s first-time buyers and highlighted key statistics you need for a wider understanding of the property landscape in 2023.

But what does the average first-time buyer in the UK look like in 2023, and what are the ongoing trends and changes that are impacting the property market?

Key UK First-Time Buyer Statistics 2023

Key UK First-Time Buyer Statistics 2023

- 77% of non-property owners say they don’t think they’ll ever be able to purchase a property

- 25 to 34-year-olds made up the majority of first-time buyers between 2021 and 2022

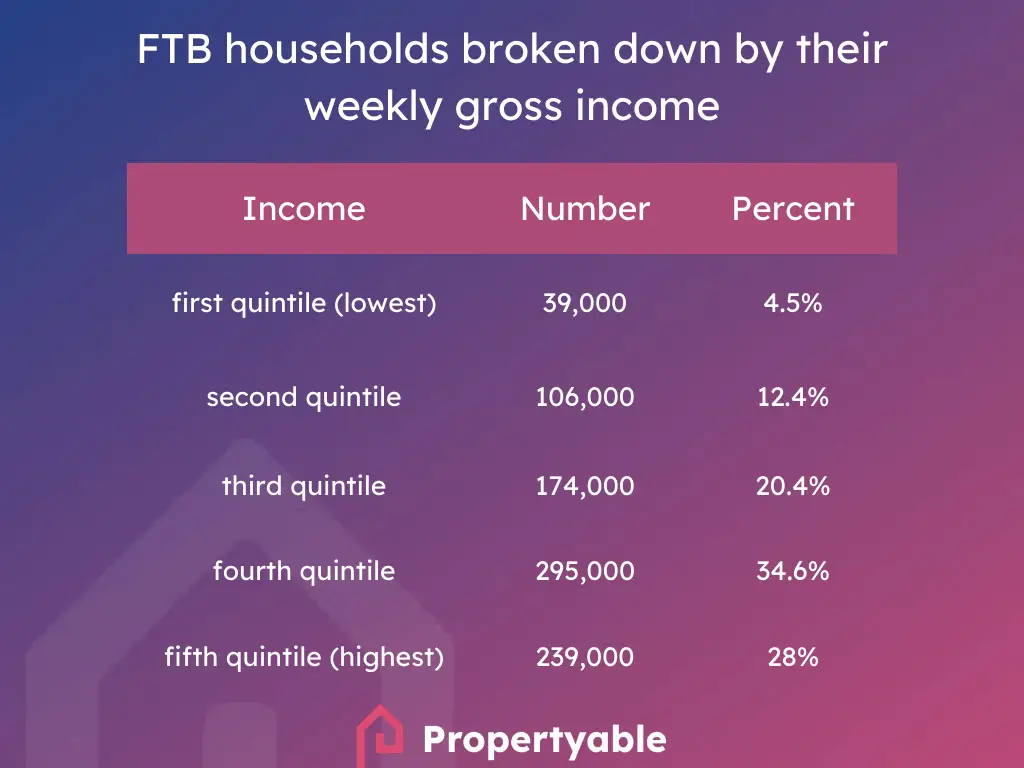

- The two highest-earning quintiles make up over half (63%) of the overall first-time buyer households

- Lone-parent households with at least one dependent child made up just 3% of all first-time buyer households between 2021 and 2022

- In December 2022, the average house price for a first-time buyer was £262,527

- In 1993, first-time buyer prices were £48,000 on average and since then they have risen by 437% to an average of £258,000 in 2022

- The average house price for first-time buyers was £262,527 by the end of 2022 whilst the average salary was £31,285

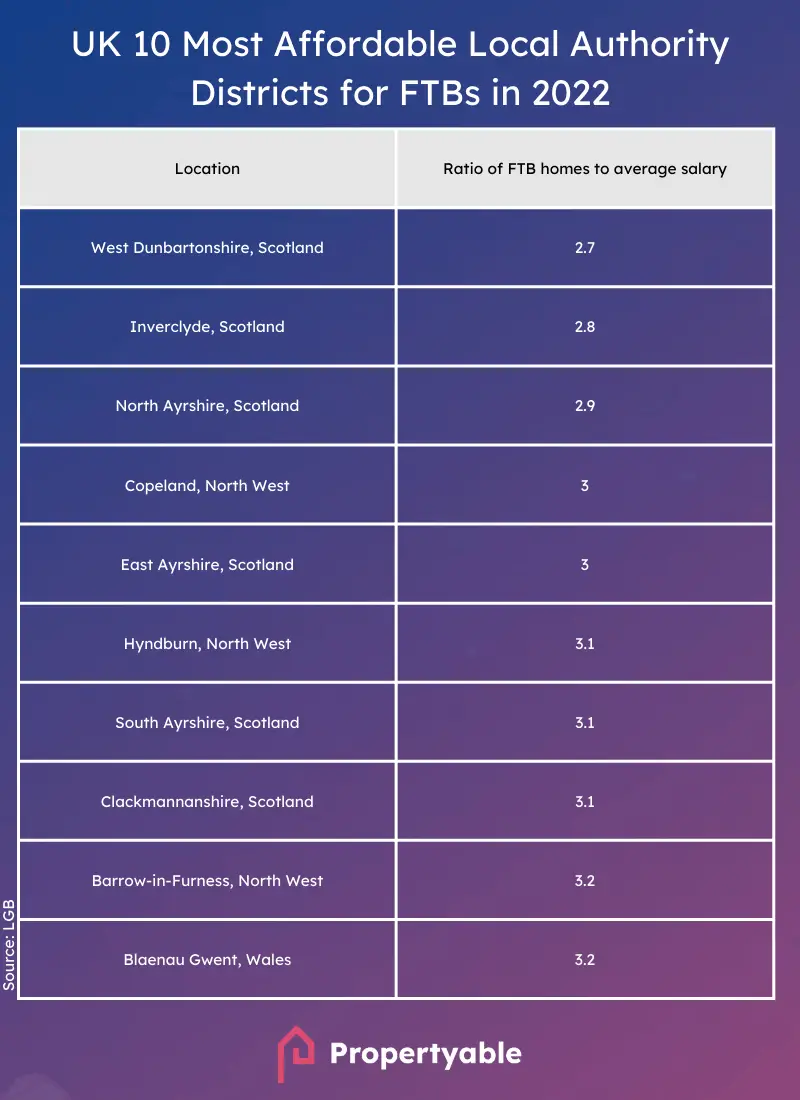

- West Dunbartonshire is the most affordable for first-time buyers as the area’s average earnings are £37,910 with first-time buyer prices averaging out at £103,957

- As of December 2022, the average house price in the UK is £294,329, falling by 0.4% to the previous month. However, overall they have risen by 9.8% when compared to the previous year.

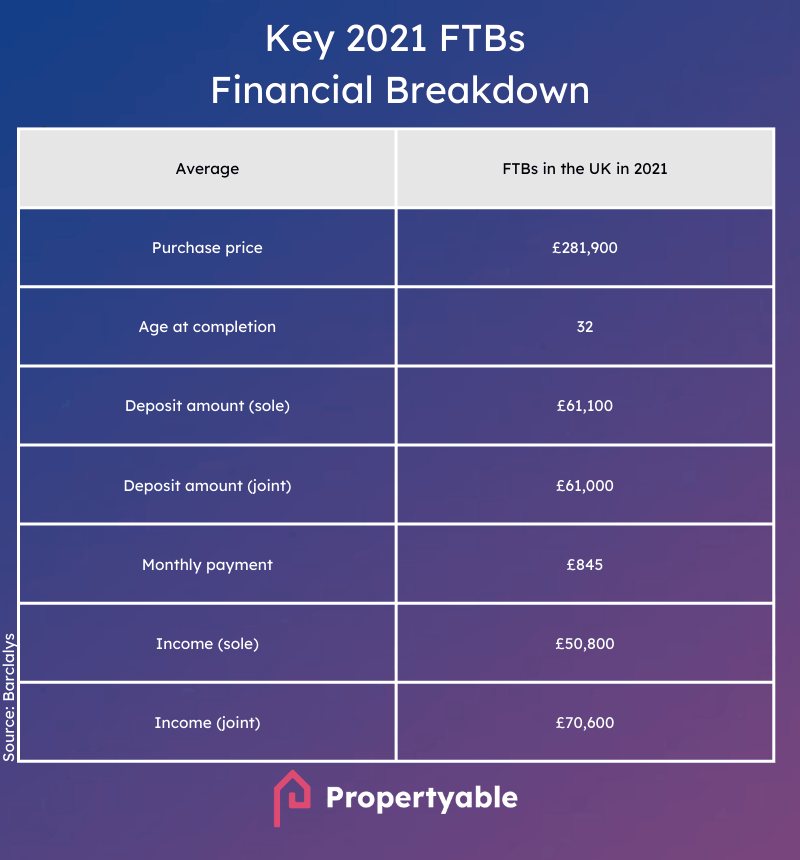

- In the UK, the average first-time buyer begins to save for a house deposit at the age of 24, with the majority of savers reaching their goal by 32

- 224,000 first-time buyer households used money from a gift or a loan from family members or a friend to pay for the deposit on their first-time home purchase

- The average first-time buyer mortgage size is £198,779

- The majority of first-time buyer mortgages had over 30 years to run on the mortgage once it was taken out, with over half (56%) of households saying so

- By 2021, 39,200 first-time buyers had bought their house through the ‘Help to Buy’ scheme, with the scheme closing to new applications on 31 October 2022

- Over half (55%) of budding or existing first time buyers have admitted that they lack the knowledge needed to begin the process of getting onto the property ladder

First-Time Buyers Data 2023 - Propertyable Survey

To provide an insight into the behind-the-scenes of first-time buyers’ perspective in the UK in 2023, Propertyable surveyed 2,000 people.

Each person was asked if they believe that they’ll ever be able to purchase a home.

A staggering 78% said they don’t think they’ll ever buy a property and begin their journey on the property ladder. That leaves just 22% of people who believe that they will be able to purchase a property one day.

The Characteristics Of First-Time Buyers in 2022

First-time buyers change their approach and activity depending on a number of environmental, financial and personal factors. This means the UK often sees fluctuation in the number of first-time buyers actively purchasing a property, along with changes in the details.

Understanding the characteristics of first-time buyers can help to paint a picture of the landscape of first-time buyers and the groups of people who have managed to get their foot on the property ladder in recent years.

It’s important to mention that first-time buyers have to deal with many obstacles, and some groups will be faced with a disproportionate amount of hoops to jump through due to their own personal circumstances.

The Age Of First-Time Buyers In 2022

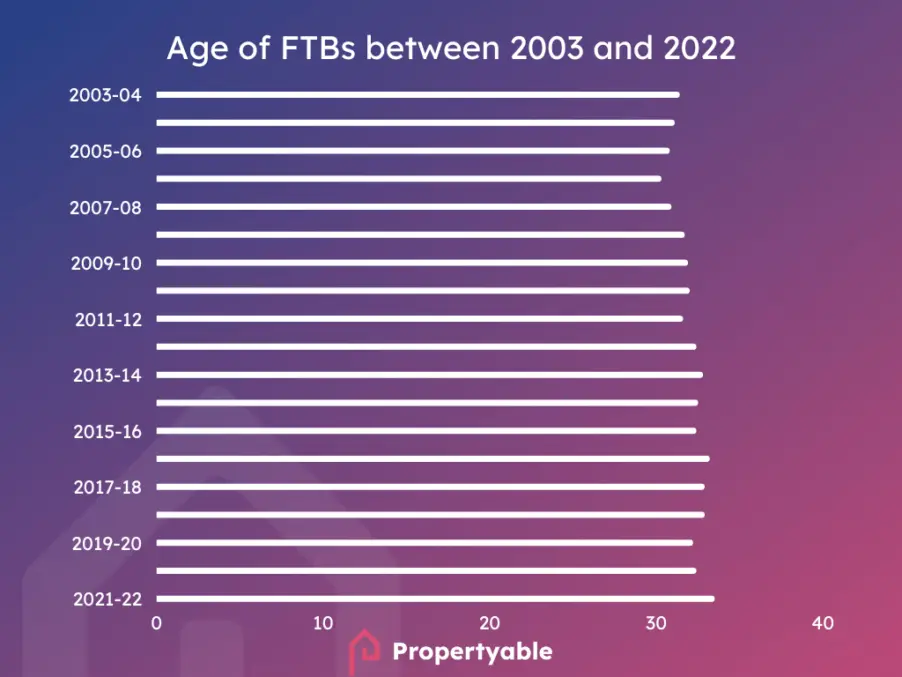

The average age of first-time buyers in the UK between 2021 and 2022 was 34 years old.

Analysing the changes over the years, Propertyable found that the average age between 2021 to 2022, 2020 to 2021 and 2019 to 2020 the average first-time buyer age was 32. This means that the average age in the last five years was 32.

Take a look at the graph below for a breakdown of the last decade, highlighting the changes in the age of first-time buyers between 2003 and 2022.

Taking a closer look at the ages of those buying their first property, Propertyable found that 25 to 34-year-olds made up the majority of first-time buyers between 2021 and 2022. You can find a breakdown of all age groups and how they make up the first-time buyer demographic in the following table.

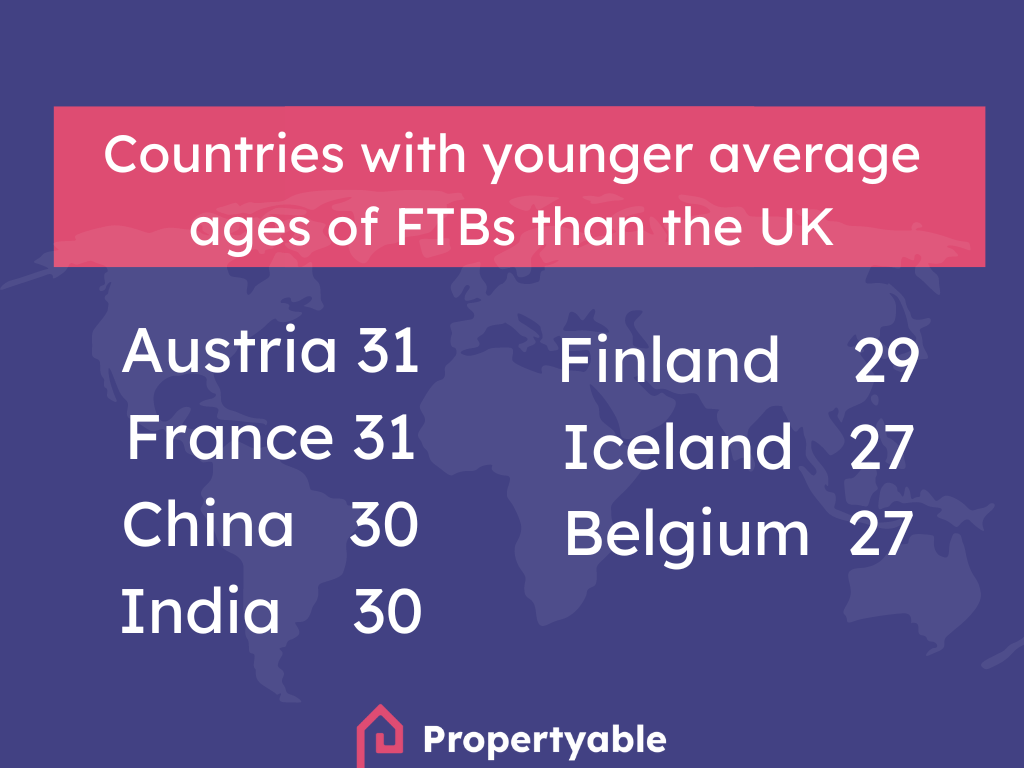

First-time buyers in the UK have their own unique experience of the property market, as every country has distinctive and individual factors that impact how the landscape is shaped. To provide another insight into first-time buyer statistics in the UK, Propertyable has assessed how other countries compare…

Taking a look at the average age of first-time buyers across the globe, there were only seven countries that had younger buyers than the UK’s average of 32 in 2020.

The Demographic Details Of First-Time Buyers In 2022

Analysing the numbers, Propertyable found that of all 852,000 first-time buyer households, only 137,000 were of an ethnic minority background, meaning 84% were white.

A household’s income is just one factor when it comes to their ability to purchase a home, however, as the process is notoriously costly it’s fair to assume that the higher the income the higher the likelihood. This is evident by the fact that the two highest earning quintiles make up over half (63%) of the overall first-time buyer households.

To break down how a household’s income can impact their ability to purchase a first property, Propertyable has highlighted the number of first-time buyer households along with their weekly gross income…

The First-Time Buyer Households In 2022

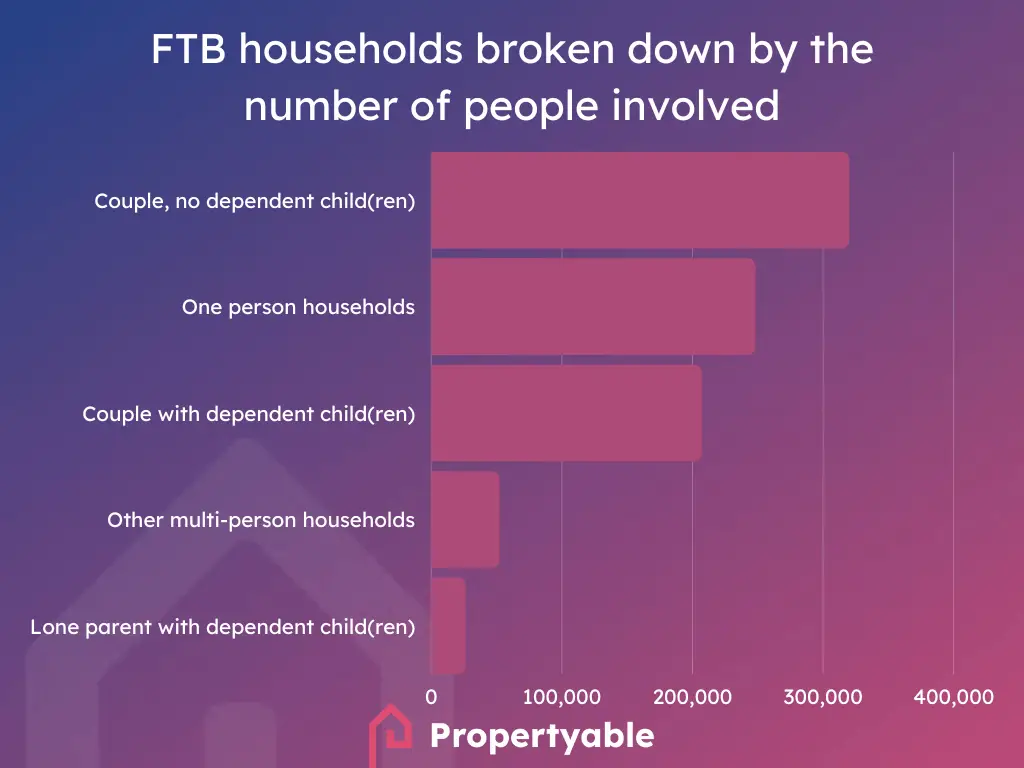

Similar to the demographic details, different types of households will have varying experiences throughout the process of buying their first property.

For example, those with children will require a more specific type of property that is suitable for family life, whilst a single-person household may experience a greater financial strain due to having just one income.

But how has this impacted the number of people purchasing their first property?

Inspecting the available data, Propertyable found that just over a third (38%) of first-time buyers were a couple with at least one child who is no longer dependent, whilst just under a third (29%) were single-person households. Meanwhile, couples with at least one dependent child accounted for 24%.

Lone-parent households with at least one dependent child made up just 3% of all first-time buyer households between 2021 and 2022, other multi-person households accounted for 6%.

The Number Of First-Time Buyers In 2022

Much like anywhere else in the world, the number of first-time buyers in the UK fluctuates constantly. Financial, environmental, personal, industry and societal factors all have an impact on whether or not people can begin their journey on the property ladder.

Naturally, a pandemic will also have a huge impact, however, it’s a complex landscape. For example, the multiple lockdowns may have pushed people out of work and into greater financial difficulty, but they also led to many reducing their expenditures and saving towards a deposit instead.

Let’s look at the number of first-time buyers in the UK and how they’ve changed over the years.

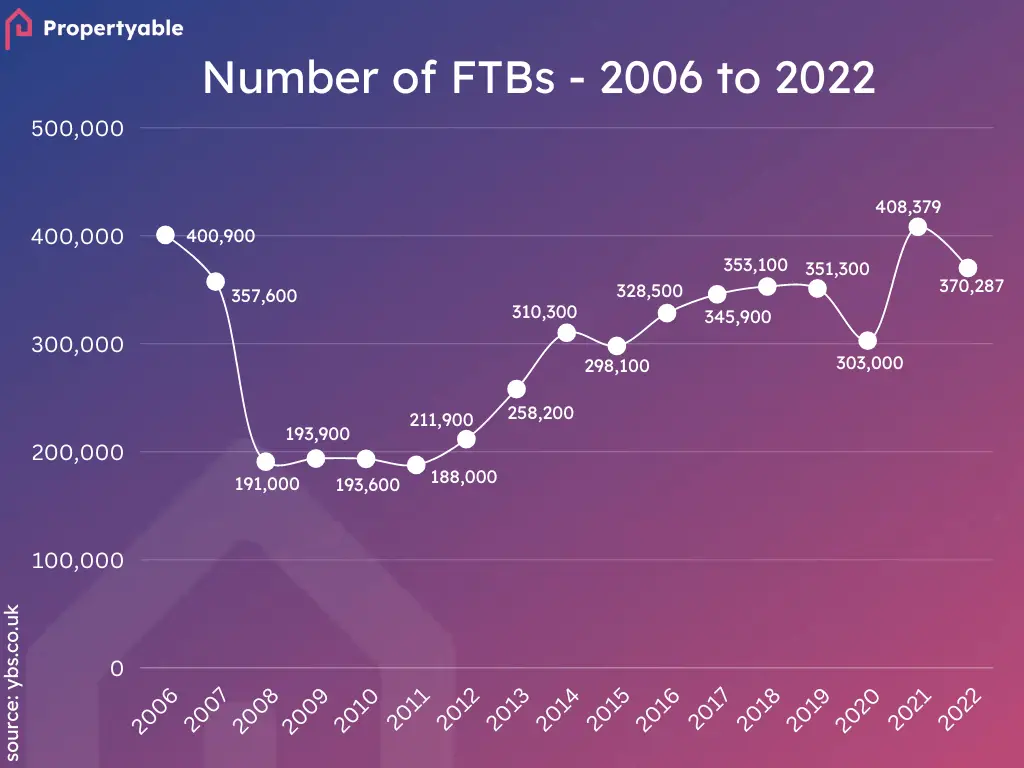

In 2022, the UK saw over 370,000 first-time buyers. This was a slight drop compared to 2021, as that year first-time buyer numbers hit the highest they have in over 15 years, with a huge 35% increase. This may have been due to a number of factors, including lockdowns reducing spending and the stamp duty relief scheme.

Despite the recent drop, first-time buyers currently account for 53% of the overall buyers in the UK – the highest it’s been in over a decade.

The Number Of ‘Recent’ First-Time Buyers

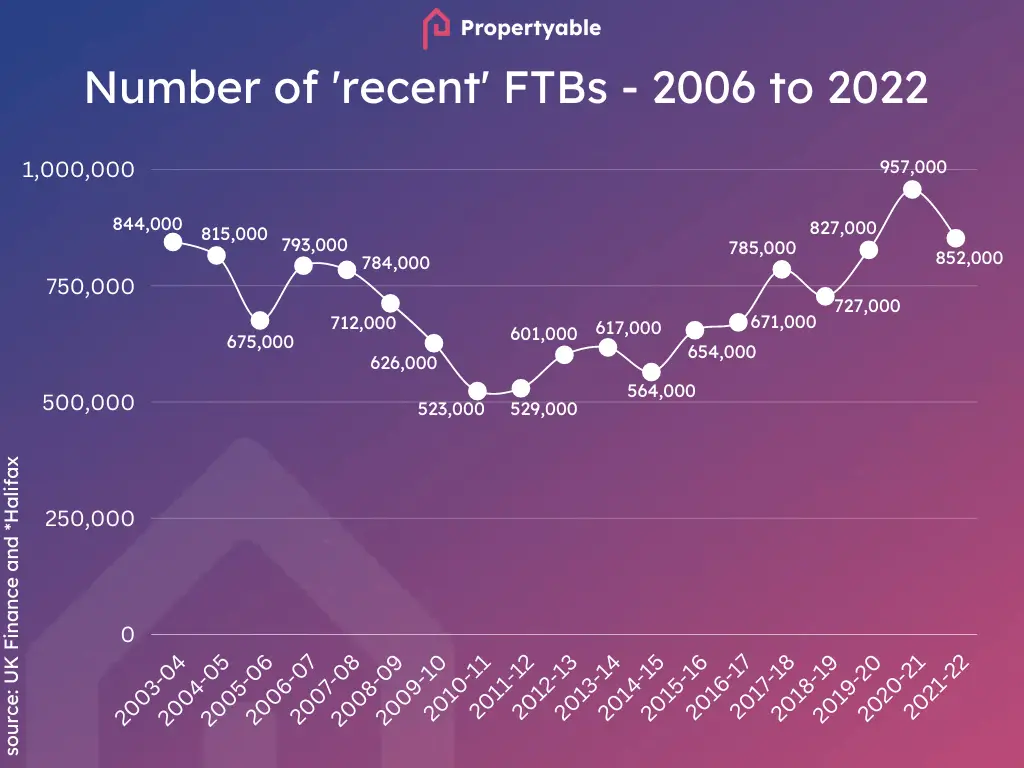

Breaking down the data, Propertyable found that between 2021 and 2022 there were around 852,000 recent* first-time buyers in England. This was found to be 100,000 less than between 2020 to 2021.

*Recent first-time buyers are defined as an FTB who purchased their first property less than three years prior.

Over the last ten years, this hasn’t fluctuated massively, with a relatively steady number of recent first-time buyers. Between 2018 and 2019, there were 727,000 recent first-time buyers and from 2019 to 2020 there were 827,000. This means that there was an average of 840,000 recent first-time buyers in the UK in the last five years.

Take a look at the graph below for a breakdown of the last decade, highlighting the changes in the number of recent first-time buyers between 2003 and 2022.

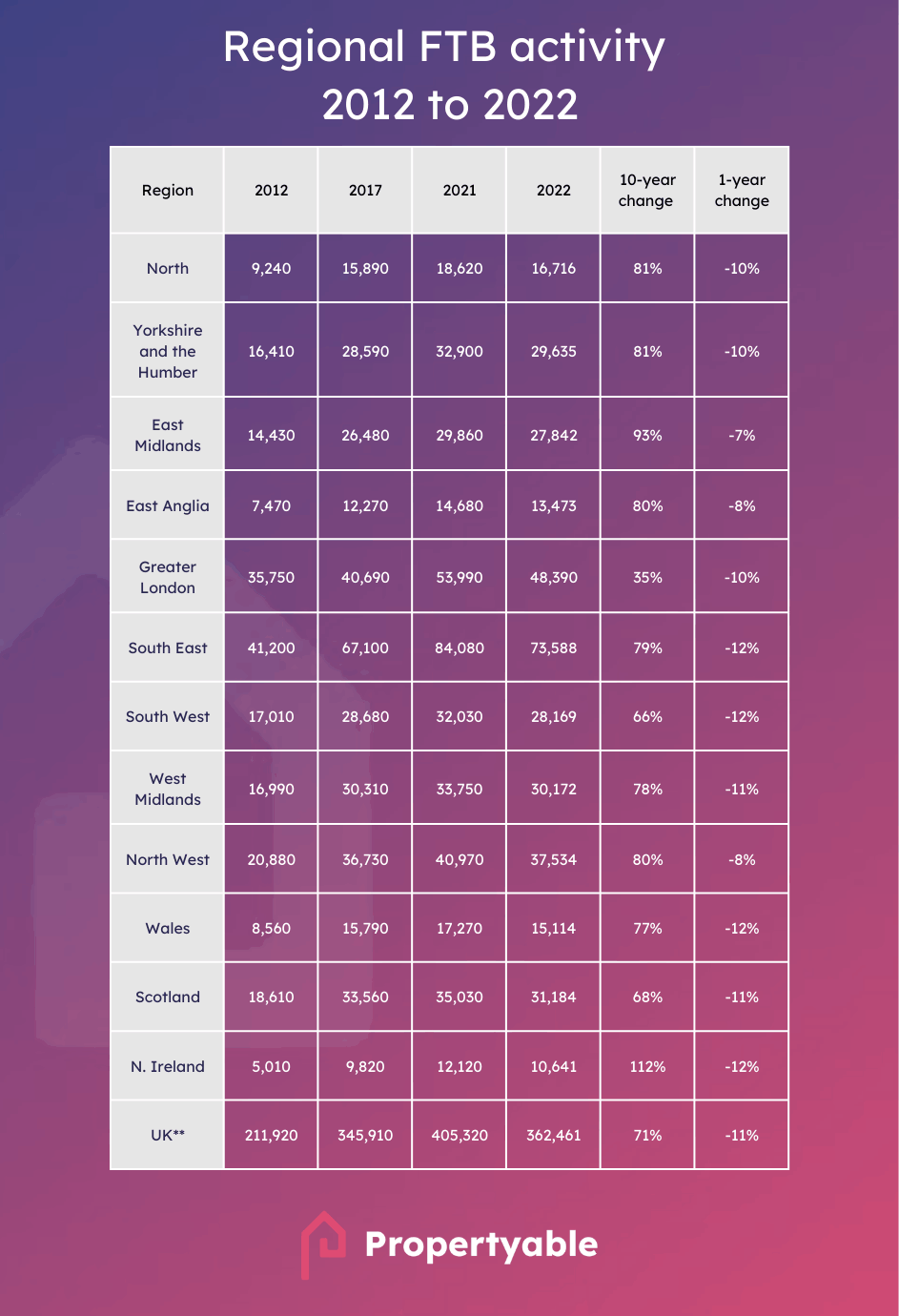

A closer look reveals how each region in the UK has seen changes in the number of first-time buyers purchasing properties.

Overall, the number of first-time buyers fell in 2022, but the regions with the biggest drops were in the South East, South West, Wales and Northern Ireland. These regions all saw a drop of 12% in first-time buyer purchases, however, they also saw a huge demand in 2021.

Meanwhile, the East Midlands retained the largest number of first-time buyers as the region saw the smallest fall of 7%.

Assess the details in the table below to get a fuller picture of first-time buyer activity across the UK…

Overview Of Property Market Trends For First-Time Buyers

The behaviour of first-time buyers in the UK in 2023 can change due to a number of factors, whether they’re more personal reasons or a broader challenge shaped by the property market at that time.

To find out more about the personal challenges first-time buyers in the UK are facing in 2023, take a look at our Propertyable report.

We also broke down the latest data to provide insight into the significant market trends that first-time buyers face, along with our expert-led predictions for 2023 and upcoming years.

First-Time Buyer Prices

First-time buyers are on the first few rungs of the property ladder and their journey has yet to progress, meaning they may have a tighter budget than others. So, what is their budget and what is the average price of first-time buyers’ purchases? Take a look below to see how these prices have changed over the past five years…

Figures in England showed that in December 2022, the average house price for a first-time buyer was £262,527. This has risen by £60,024 since January 2018 (29.6%). In fact, in 2022 alone, these figures rose by 9%, accounting for almost a third of the overall five-year increase in just 12 months.

In fact, these figures rose so quickly in 2022 that the overall increase between January 2018 and December 2020 came to 9.3%, just 0.3% more than the overall increase in the last year alone.

Further information provides is a deeper insight into how first-time buyer prices have changed in the last two decades.

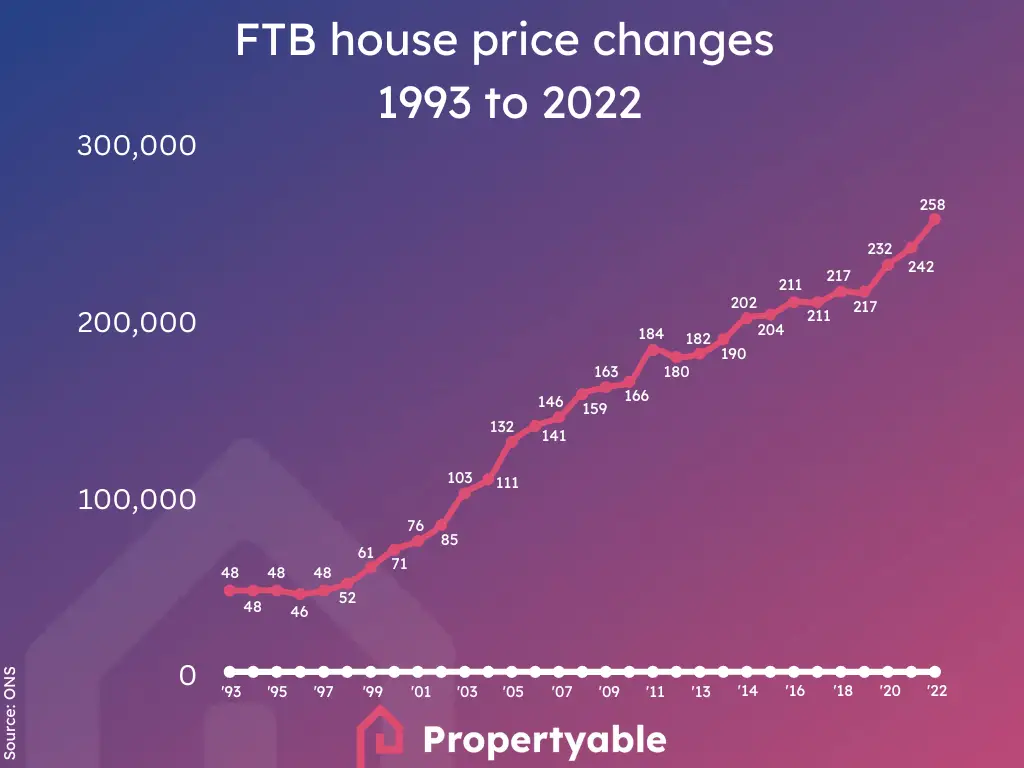

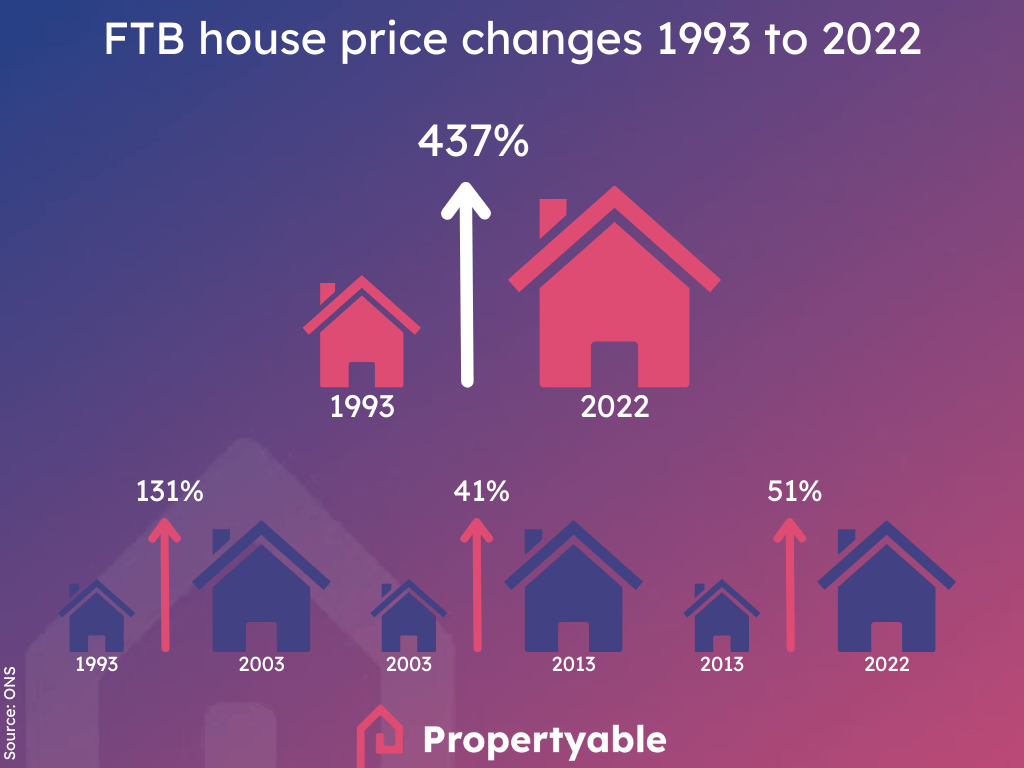

In 1993, first-time buyer prices were £48,000 on average. Since then they have risen by 437% to an average of £258,000 in 2022.

In 2002, these prices hit over £100,000 for the first time. But before they reached six figures, how did the rate of price increases compare to the last ten years?

Between 1993 and 2003 first-time buyer prices jumped from £48,000 to £111,000. This was a percentage increase of 131%, with the biggest jump in price happening between 2002 and 2003 with a 21% rise in prices.

Between 2003 and 2013, there was a 41% increase in first-time buyer house prices (£74,000 to £104,000). In the last decade, the percentage increase of first-time buyer prices was found to be 51%, with prices rising from £104,000 to £157,000.

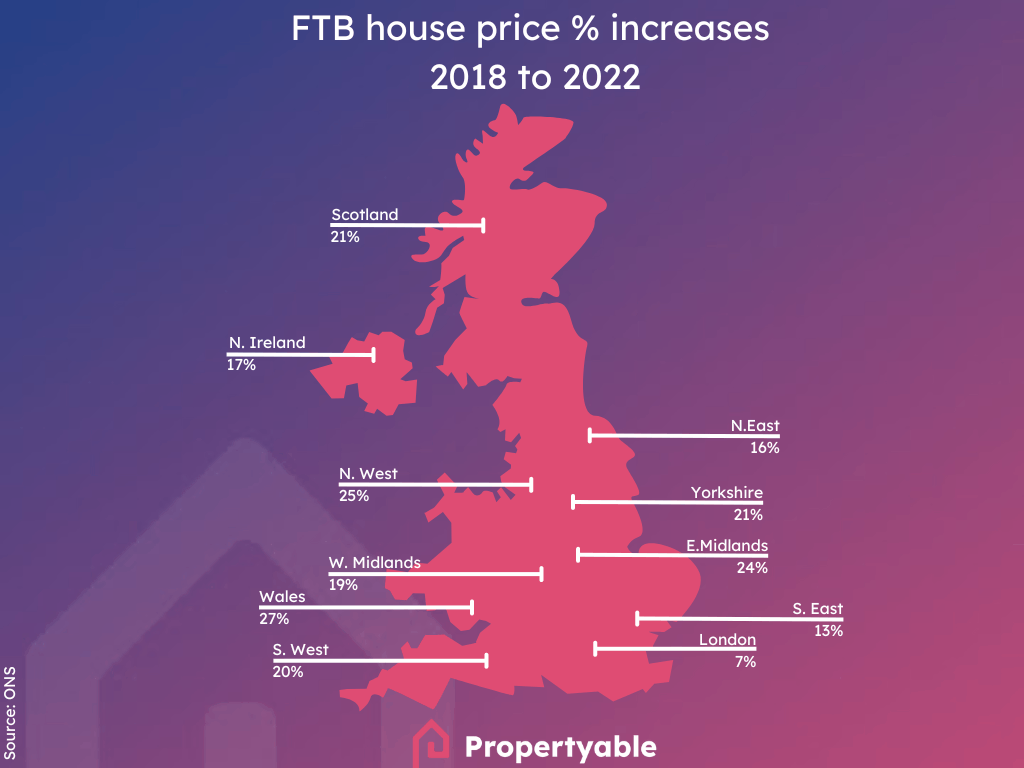

Taking a closer look at how first-time buyer house prices have changed across the UK, Propertyable has broken down the last five years of changes across each region (2018 to 2022).

Average House Price vs Average UK Salary

It’s clear that house prices have been on the rise for decades, as evidenced by the data above. But, have people’s salaries matched house price increases, or are they trailing behind?

The average house price for first-time buyers was £262,527 by the end of 2022 whilst the average salary was £31,285. This is compared to five years ago, when in 2018 the average house price for first-time buyers was £202,498 whilst the average salary was £29,599.

The percentage increase of houses in this time period was 30%, whilst the increase in salaries was just 5%.

Looking closer at the numbers, the average home in the UK cost £279,431 in the first quarter of 2022, However, the average annual earnings were £39,402. This resulted in a house price-to-income ratio of 7.1, the highest ever recorded.

This, compared with 2020’s ratio of 6.2 shows a clear increase in the last two years. To see how prices and salaries have changed over the last ten years, take a look at the graph.

The UK's Most Affordable Local Authority Districts For FTBs In 2022

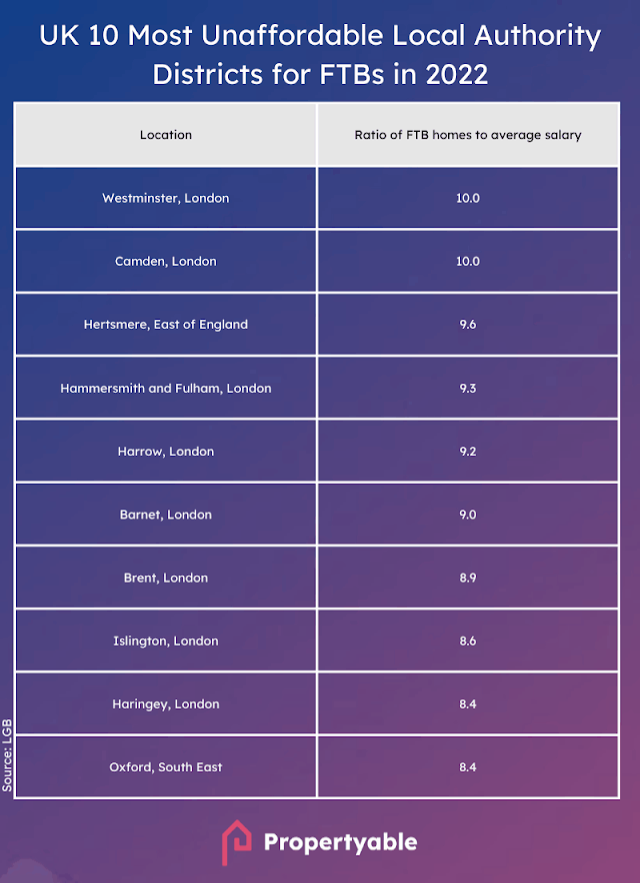

The UK's Most Unaffordable Local Authority Districts For FTBs In 2022

House Price Changes 2023

The cost of a home is often the biggest obstacle in the way of first-time buyers. But what kind of landscape are they looking at in 2023 and if previous years would have presented more affordable options?

As of December 2022, the average house price in the UK is £294,329, falling by 0.4% to the previous month. However, overall they have risen by 9.8% when compared to the previous year.

Would have first-time buyers had an easier time in previous years though? Analysing house prices found an overall increase of 31% in 2018, with average prices rising from £224,544 in January 2018 to £294,329 in December 2022.

In January 2021, the average house price in the UK was recorded at £249,690, meaning there has been an increase of 17.8% (£44,639) between January 2021 and December 2022.

Looking further back, house prices in January 2020 were averaging at £231,940, which rose to £268,115 by December 2021 (15.5%). The rise was much less the year prior, with an 8.6% increase from January 2019 to December 2020

The year with the biggest change since then was 2022, with prices rising by £21,334 that year alone. 2019 was the year with the smallest change, as average prices only rose by £3,478 between January and December ‘19.

Different types of properties saw different levels of rise in their prices and it’s important to know how this may affect those who are trying to get onto the property ladder with a good investment.

In the last five years, detached properties were found to have had the most significant increase in price. The average cost in January 2018 was £364,058, which has risen to £494,459 in December 2022 – an increase of £130,401 (35.8%).

Semi-detached homes had the second highest rise with 35.4%, terraced with the third highest with 33.2% and flats/maisonettes with 13.1%.

Investment Index Changes For First-Time Buyers

For many first-time buyers, the initial investment of their savings can be overwhelming. However, it’s important for anyone on their property journey to remember the value behind their purchase and the potential investment return.

First-time buyers should be aware of these changes, and keep them in mind when deciding on the right home for them.

Taking a brief look by analysing the trajectory of these rises, it could be suggested that house prices and the index stands at 154.37. Property prices have fallen by 0.4% compared to the previous month and risen by 9.8% compared to the previous year.

First-Time Buyers’ Deposit Statistics 2023

A deposit is paid to a lender and is a sum of money that is used as a first instalment on a property. This leaves the remaining mortgage balance to be paid off over the agreed amount of time.

In the UK, the average first-time buyer begins to save for a house deposit at the age of 24, with the majority of savers reaching their goal by 32. However, 73% say they regret not starting their saving journey earlier.

In the UK, it’s common to need at least 5% of the overall price to act as a deposit for your mortgage.

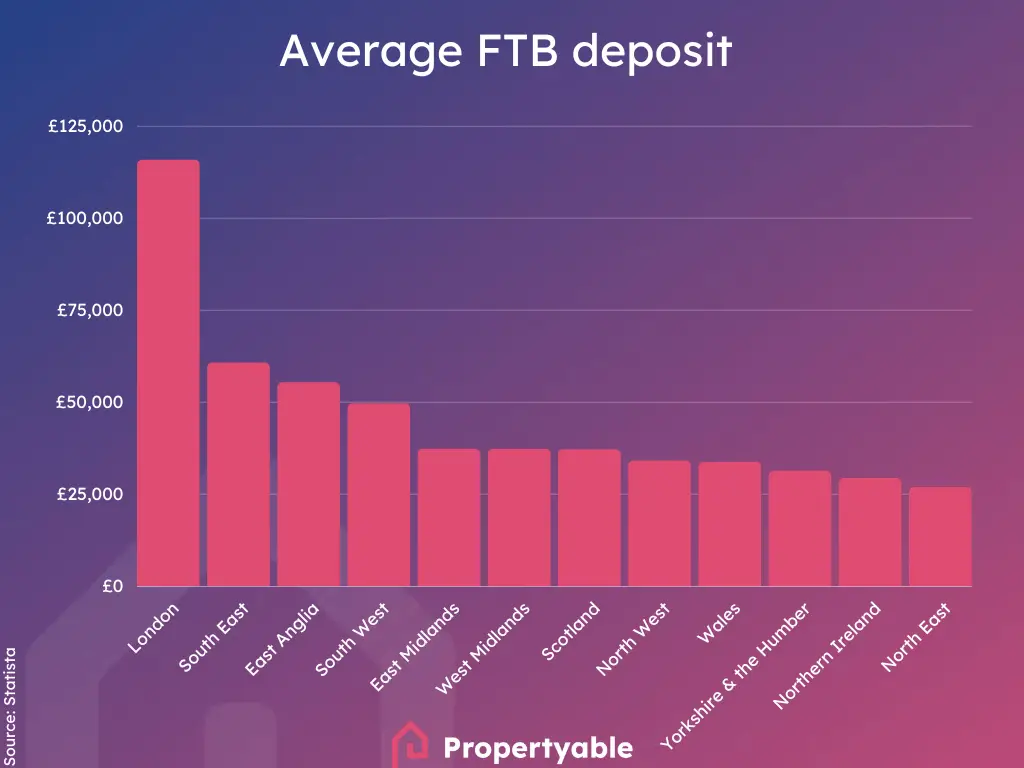

However, the average deposit for the UK’s first-time buyer amounts to around £61,000. This averages out to 26% of the average first-time buyer’s house price.

Saving for this deposit can take a long time and can be a struggle for many first-time buyers. Between 2021 and 2022, the number of first-time buyer households that saved the deposit for their first property with savings was 704,000, accounting for 85% of all households.

Meanwhile, 224,000 households used money from a gift or a loan from family members or a friend to pay for the deposit on their first-time home purchase (27%).

68,000 households used money from an inheritance, whilst 10% used funds from another source.

First-Time Buyers’ Mortgage Trends 2023

First-time buyers, just like any other person or business purchasing property, have to apply for a mortgage. So how have these mortgage applications changed over the years and what size mortgages are the UK’s first-time buyers taking out in order to get their foot on the property ladder?

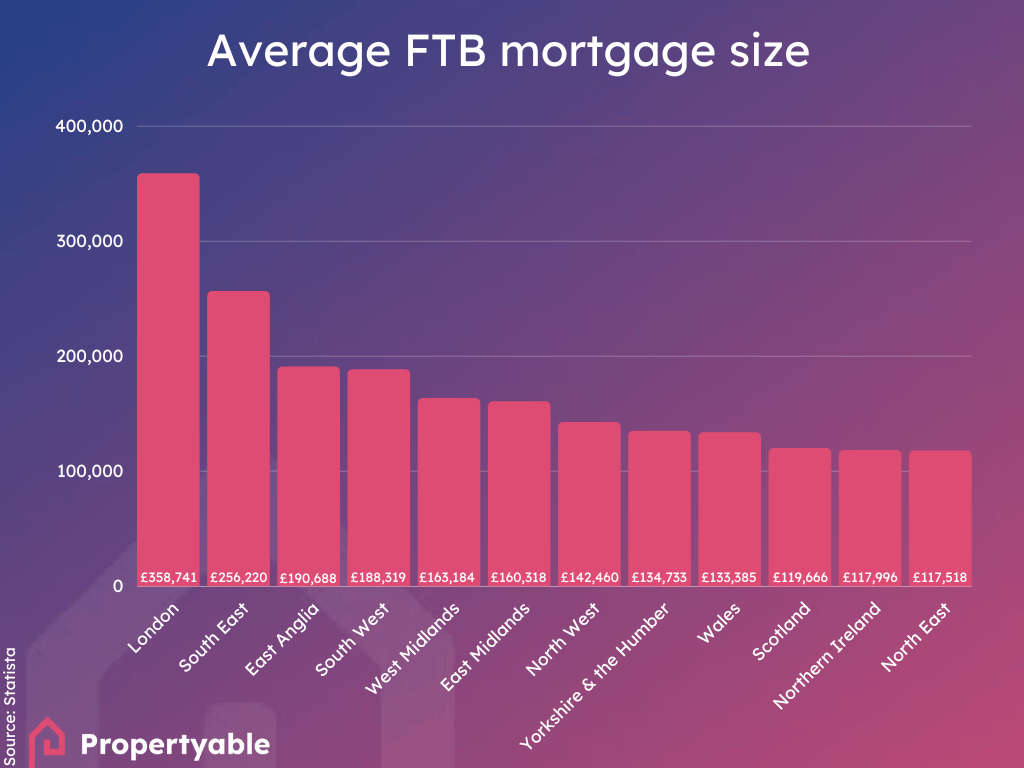

Looking into the data, Propertyable found that the average first-time buyer mortgage size is £198,779. However, due to London’s inflated house prices, it’s important to take a look at the regional information to gain a more accurate sense of the mortgage sizes first-time buyers are taking out.

In fact, London’s housing market is so expensive, first-time buyers in the capital are currently looking at an average mortgage of £358,741. Compared to the lowest FTB mortgage in the UK, the North East has a three times lower mortgage size average.

First-Time Buyer Mortgage Application Changes

In the last three years, the average amount of first-time buyer mortgage applications has accounted for a third of all house purchase mortgage applications.

Broken down, in the first three quarters of 2022, 66% of mortgage applications were for a house purchase, of which 22% were first-time buyer mortgage applications. This is compared to 24% in 2021 of 72% of house purchase applications and 21% of 65% of house purchase applications.

Analysing how these numbers have changed over the years highlights a fairly consistent amount of first-time buyer mortgage applications against the percentage of house-buying applications.

For example, in 2007, of 53% of house purchase applications, 13% were for first-time buyers. Both percentages have dropped by around 10% compared to the last few years, highlighting an increase in applications whilst the overall percentage between the two types of buyers remains relatively similar.

First-Time Buyer Mortgage Application Details

Delving deeper into the numbers, Propertyable has broken down the details behind these mortgage applications. Take a look below for some quick facts that illustrate the landscape of first-time buyer mortgages…

The most common type of mortgage amongst first-time buyer households is a repayment mortgage, with 727,000 saying they took out this type of mortgage on their first property (98%).

The majority of first-time buyer mortgages had over 30 years to run on the mortgage once it was taken out, with over half (56%) of households saying so.

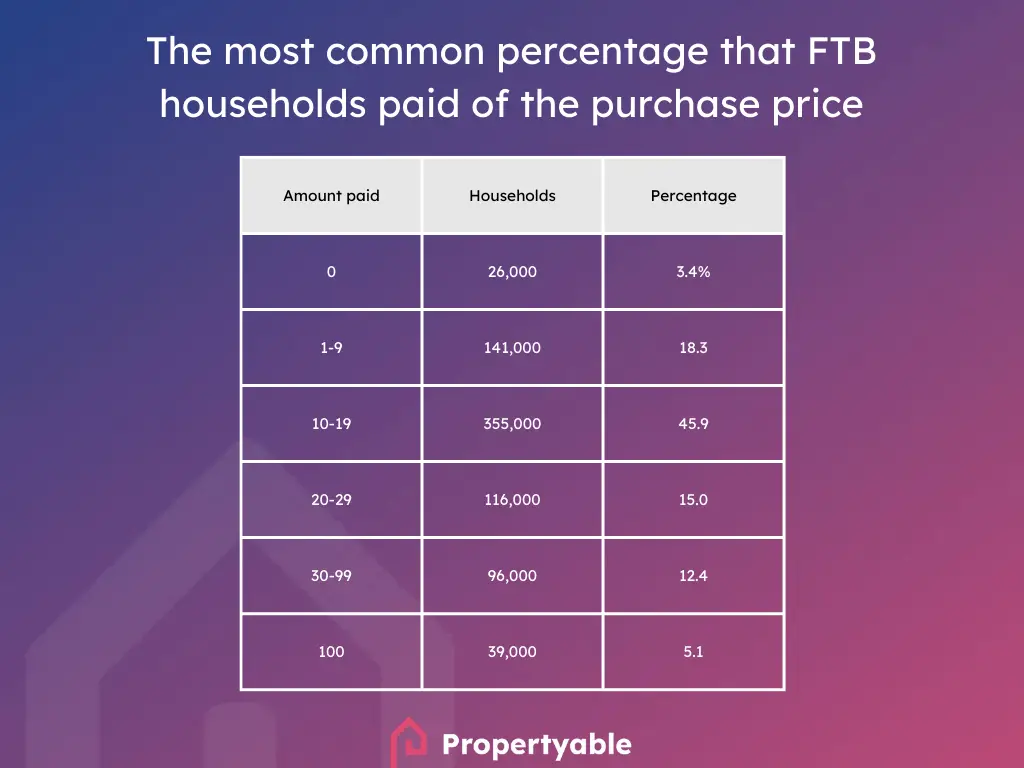

The most common percentage that households paid of the purchase price was 10-19%, with 355,000 first-time buyer households saying so, accounting for 46% of all households.

The second most common percentage of the purchase price paid was 1-9%, with 141,000 (18%) saying so.

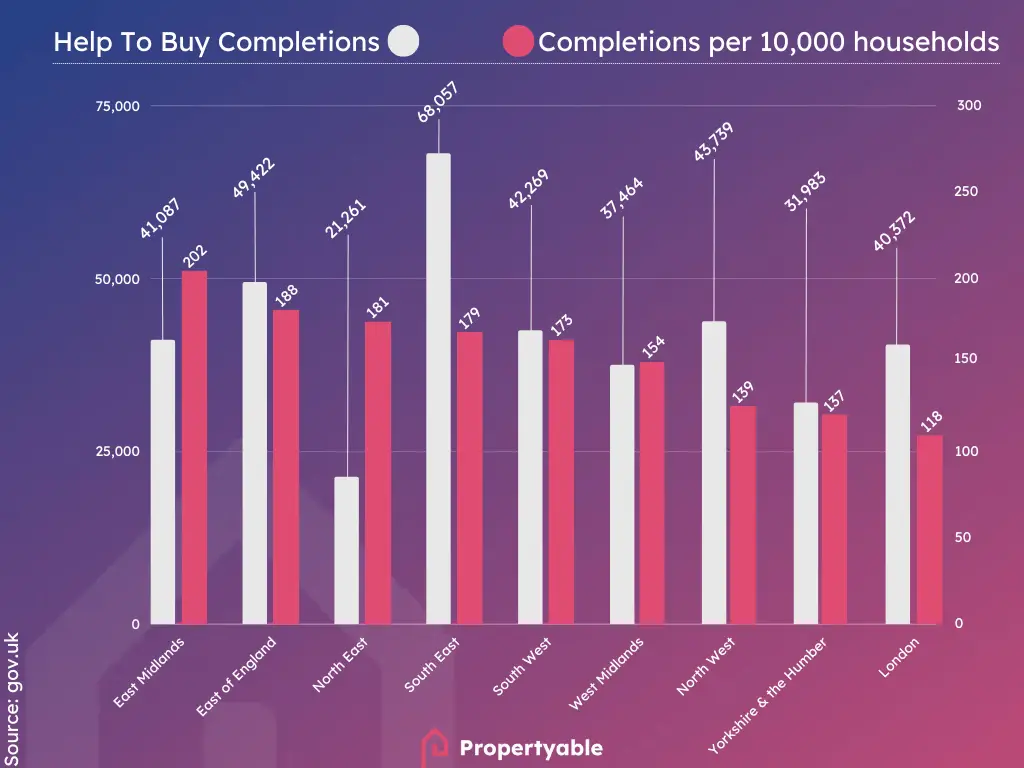

Trends For The Help To Buy First-Time Buyers

It’s no secret that first-time buyers can often face an uphill battle when on the path to becoming homeowners. To give people a much-needed boost, a number of schemes, programs and options are available for specifically first-time buyers to take advantage of.

One of these schemes was the ‘Help to Buy’ scheme which was curated to support people in buying a home. It allowed buyers to borrow up to 20% of the value of a new build home, and borrowers would have five years of no interest on the loan too.

In its lifetime, the scheme supported the purchase of 375,654 properties, with 84% being first-time buyers’ properties. By 2021, 39,200 first-time buyers had bought their house through the ‘Help to Buy’ scheme, with the scheme closing to new applications on 31 October 2022.

Take a look at the graph to see how the UK made use of the ‘Help to Buy’ scheme and which regions got the most out of it.

First-Time Buyer Interview & Expert Response

Take a look at how first-time buyers’ interact with the property market with a real account from Siobhan – a first time buyer who had to balance a breakup and an unstable financial landscape.

First-Time Buyers Resources & Guides

Life as a first-time buyer can be a bumpy ride. There is a whole world of complex processes to understand and it can often become confusing and time-consuming, taking the joy out of the overall experience. In fact, over half (55%) of budding or existing first-time buyers have admitted that they lack the knowledge needed to begin the process of getting onto the property ladder.

At Propertyable, we believe that it can be made easier when you have experts and a community alongside you. Helping all different types of people at different stages in their property journey, we have a variety of guides to support first-time buyers, investors and those renting their properties.

Buying a house for the first time can be a shock to the system when you realise the hidden costs behind each step of the way. Being prepared is the best way to avoid a nasty surprise, and feel more confident in your decisions. Be the expert in your own property journey and discover the real cost of buying a house before you have to open your chequebook.

There are so many different schemes and programs designed to assist first-time buyers, and the details behind stamp duty are not one to be missed. Get all the information you need to make the best possible financial decisions when purchasing your first home with our comprehensive guide on stamp duty.

Instead of tripping and falling through the house-buying process, be a confident and assured first-time buyer with Propertyable. Our experts have given you a look into the future with a thorough step-by-step guide to buying a home. Have a read and take some notes and rely on us to be with you throughout the whole process.

If you’ve found a home and you’re ready to make an offer, don’t let the fear of the unknown put you off. Avoid making rookie mistakes and enjoy a smoother process with our comprehensive guide. We breakdown every key step, from finally deciding on the property for you, to signing the contract. Make an informed and confident decision with Propertyable.

© Copyright Propertyable 2024. All rights reserved.