Stamp Duty Rate Changes in England and Northern Ireland: What You Need to Know for April 2025

If you’re buying a home, you’ve probably heard about stamp duty as being one of the additional costs you have to plan for when...

Deciding whether to sell or rent out your home is a significant choice that requires careful consideration. Various factors come into play, from financial implications to market conditions. In this article, we will explore the key considerations that can help you make an informed decision that aligns with your personal goals and circumstances. When does […]

Lisa Best

04 January 2024

Table of Contents

Deciding whether to sell or rent out your home is a significant choice that requires careful consideration. Various factors come into play, from financial implications to market conditions. In this article, we will explore the key considerations that can help you make an informed decision that aligns with your personal goals and circumstances.

Table of Contents

Renting may make more sense when you are not in an immediate need for funds, for example towards another property, if housing demand is strong and you cannot find something to buy immediately but want to sell for the best price, or you foresee potential appreciation in property values. Additionally, if you’re attached to your property and reluctant to let it go, renting can provide an alternative and allow you to take you time to make a final decision on whether to sell.

Renting can be beneficial, by giving you an additional income and, if you get a good tenant, they will likely look after the property for you. However, renting a property out does come with risks, mainly the maintenance you will need to fund, the risk of getting a bad tenant who causes damage or fails to pay rent and the fact that you will have to pay income tax on the income from the property.

Selling the property can mean you get access to more funds and have less hassle with maintenance and damage. However, by selling, you will be selling an asset that may grow considerably in value and the property may take time to sell, which means increased short-term costs in terms of bills and maintenance.

In general, if property prices are rising, on the one hand, you are likely to get a good price, but on the other hand, you could gain more in capital appreciation over the coming years, and renting would make sense. However, if prices are falling, selling would avoid any further loss, whilst renting out would provide an income whilst giving the market a chance to restore and prices to rise again.

In the short term, property prices can be influenced by many factors and can rise or fall. However, if you look at previous data, prices generally rise over the long term. While you can never guarantee when and by how much property prices will rise or fall, there are steps you can take to make sure you place yourself in the best possible position for every eventuality:

Before considering renting, check with your mortgage company. If you can’t rent it out under your existing mortgage, you may be required to take out a new ‘buy to let’ mortgage on the property. Buy-to-let mortgages often come with higher interest rates and you may have to pay exit fees from your current product. It’s crucial to be transparent and seek permission to avoid legal issues further down the line.

Alternatively, you may be able to apply for a “Let to Buy” mortgage to buy your next home. If you have enough equity in your home, you remortgage to get funds to put down a deposit on a new home. You then use the rental income to cover the mortgage on your home.

A good mortgage broker will help you understand what your mortgage payments will be and what mortgage interest rates may be available to you.

Assess your financial situation. Can you comfortably cover your existing mortgage while managing the costs associated with being a landlord? If you have a void period, can you afford to cover both mortgage payments? Ensure your rental income covers expenses and leaves room for unforeseen circumstances. It may also be worth checking with your lender if they offer ‘mortgage payment holidays’ in the event of an unforeseen circumstance.

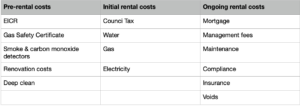

Costs to consider when renting a property out include:

Understand the tax implications of renting before deciding whether to rent or sell your property. Rental income (not just profit) is subject to income tax, and if you sell later, capital gains tax may apply. A landlord in the higher tax band, will pay tax on their rental income at 40% or 45% but will only be able to claim 20% tax relief. Research tax rules in your location and consider consulting a tax professional.

Capital Gains Tax is the tax payable on the ‘gain’ from the property when you sell a second home, which is the difference between what you paid and what you sell for. You do not have to pay Capital Gains Tax on your main residence but will have to on a second property, even if it is inherited. Everyone has an entitlement to an annual allowance, but this can only be used once each year. You don’t have to pay if you have lived In the property within the last 18 months.

*Always seek advice from a specialist property tax professional.

As well as renting out, you may also be able to explore alternatives like a lease option or temporary housing solutions. These options allow flexibility while maintaining ownership.

When working out if renting your property will be worth it, be sure to factor in rental income, expenses, and potential property appreciation. Compare this against the financial gains from selling.

Being a landlord involves responsibilities such as property maintenance, tenant management, and understanding landlord-tenant laws. Consider the time, effort, and costs associated with these responsibilities.

Deciding what to rent your property out for depends on a number of things, including the current market in the area, the condition of the property, demand, the number of properties available to rent, and how quickly they are renting out.

For example, if you choose to set the highest price in the area for comparable properties, you may put yourself at risk of taking longer to rent the property. Having said that, the rental market in England is currently very strong, due to a lack of available stock, so rental prices have risen considerably in recent years.

You can research rental prices online, using online portals such as Rightmove. Be sure to look at comparable properties, of a similar size, similar condition, and, where possible, within one quarter of a mile of your property.

If you enlist the support of a letting agent, you will be able to use their expertise and local knowledge to set a realistic rental price.

If you decide to rent, follow a systematic approach. Market your property, screen potential tenants, draft a comprehensive lease agreement, and ensure legal compliance. Enlist the help of property management services if needed.

Here’s how to rent your house out in 10 easy steps (in England):

Step 1: Ask your lender for permission or speak to a mortgage advisor to look to switch your mortgage to a buy-to-let mortgage.

Step 2: Check your Local Authority to see if you need a license and check the Housing Health and Safety Rating System (HHSRS) for your LA.

Step 3: Research the market to get an idea of demand and current market rental values. Decide on a rental figure (but you may want to do this after step 5). Include working out your running costs as a landlord.

Step 4: Do any necessary repairs and improvements to make sure your property attracts the best tenants.

Step 5: Decide whether to market the property via an agent or if you want to do it yourself. Make sure you use an agent who is registered with a professional body such as ARLA.

Step 6: Ensure the right checks such as ‘right to rent’ and reference checks are carried out on any new tenants.

Step 7: Organise landlord insurance and consider joining a landlord association scheme.

Step 8: Arrange an inventory on the property (if you use an agent they should be able to arrange this. If you are arranging yourself, you can find an inventory clerk here). Also, ensure there is a valid EICR (Electrical Installation Condition Report) and Gas Safety Certificate.

Step 9: Ensure the tenant has correct information such as the Government ‘How To Rent Guide’, a tenancy agreement and make sure their deposit is protected in an approved scheme (if you use an agent, they should arrange this part)

Step 9: Budget for when the property is let and if you need to carry out any maintenance.

Step 10: Be sure to complete an annual tax return for your property.

Conclusion:

The decision to sell or rent your home is multifaceted, involving financial, personal, and market-related factors. While this article will help you navigate the complexities and make a decision that aligns with your objectives, you may also wish to enlist the help of professional services such as a mortgage broker to gain personalised insights based on your unique circumstances.

From mortgages and insurance to viewings, offers, exchange and completion, our Buyers’ Guide will take you through everything, step by step, from start to finish.

© Copyright Propertyable 2026. All rights reserved.