Stamp Duty Rate Changes in England and Northern Ireland: What You Need to Know for April 2025

If you’re buying a home, you’ve probably heard about stamp duty as being one of the additional costs you have to plan for when...

Once your offer is accepted it’s time to book a survey as part of the buying process. A survey is optional and shouldn’t be confused with the mortgage valuation. The lender valuation is to confirm the overall value of the property so that in the event of the mortgage lender having to sell the property, […]

Lisa Best

17 March 2023

Table of Contents

Once your offer is accepted it’s time to book a survey as part of the buying process. A survey is optional and shouldn’t be confused with the mortgage valuation. The lender valuation is to confirm the overall value of the property so that in the event of the mortgage lender having to sell the property, they will get their money back. An independent survey or homebuyer report is your opportunity to ensure you don’t get any nasty surprises when you move in.

Table of Contents

A property survey report is a detailed report on the condition of a property. It is produced by a qualified surveyor, who inspects the condition of a property to highlight issues or structural damage. If you are getting a survey when you are buying a house, don’t leave it until weeks down the line as something may come back which will make you question the purchase. It is in the best interests of you and the seller to agree on any negotiations as early on as possible, as you can both move on quickly if the sale should fall through. I

n England, it is the responsibility of the buyer to get a home survey. In Scotland, the vendor is required to produce a Home Report when they bring their property to the market.

Several factors will affect the cost of a survey. They are property type or value, property location, and the type of survey.

Example:

Property price: £200,000

Location: Manchester

Level 2 (home buyers) survey: £550

For new build properties, a RICS survey may not be required and a building snagging survey can be commissioned as an alternative. They typically cost £300-£500. A snagging survey will pick up on major snags such as things that prevent functioning, from a lack of hot water to missing door handles, and also minor snags such as cosmetic issues, like uneven paintwork or scratched surfaces. A snagging survey will highlight outstanding works, issues in quality, and where the build does not meet warranty standards. New build snagging surveys typically cost around £300.

A Home survey is optional and shouldn’t be confused with the mortgage valuation. The lender valuation is to confirm the overall value of the property so that in the event of the lender having to sell the property, they will get their money back. An independent survey is your opportunity to ensure home buyers don’t get any nasty surprises when they move in. The cost of a mortgage valuation survey can be upwards of £100, but some lenders offer this as an incentive for free. Valuations usually increase in price according to the property price.

If you’re selling a property in Scotland you must obtain a Home Report, which contains information about the condition of the property, which is available to prospective buyers for the duration the property is on sale. A Home Report costs upwards of £300. New build properties do not need a Home Report.

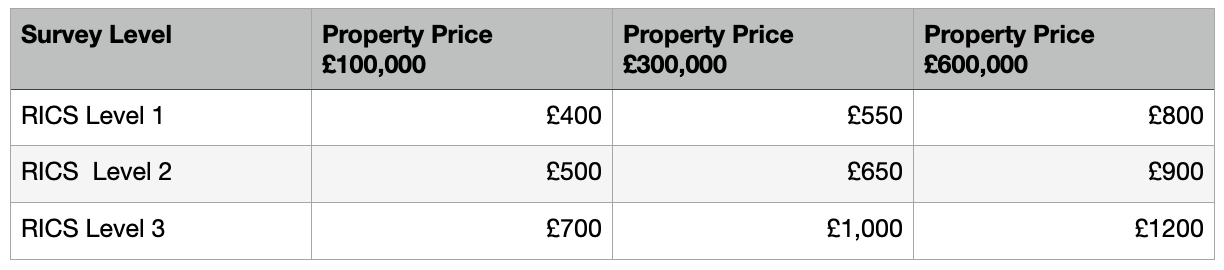

Survey posts vary according to the price of the property, but, as described above, there are three different levels of survey you can opt for. Level one is a basic report and is suited to newer properties in good condition. Level 2 is more detailed and is suitable for older properties in reasonable condition and level 3 is suited to older properties and those in poor condition as this is a full structural survey.

Example home buyer report survey checklist:

Yes! When writing the report the surveyor will categorise issues, usually making issues that should be addressed urgently as red. The surveyor will only advise on defects, not necessarily recommend action to take to address the problem. This is why sometimes a more specialist survey will be needed. For example, a damp survey can cost upwards of £100.

When you place an offer on a property it is sold subject to contract, which means the price can be negotiated before contracts are exchanged. This means that it is possible to re-negotiate on price following the survey results to take into account any repairs, however, the seller does not have to accept a lower offer. It is wise to raise any issues as soon as possible and negotiate an outcome that suits both parties.

A home survey may seem expensive to begin with, but it not only gives you peace of mind but can also help you to avoid having to deal with some very expensive issues when moving in. Having said that, this is a visual inspection and there are limitations on what the surveyor can report on, for example, if there is a lack of access.

You will probably get a residential property surveyor recommended by an estate agent or mortgage lender, but they won’t necessarily be the best or cheapest. The best way to find one is to go off recommendations from family and friends or contact a few local RICS chartered surveyors yourself and get some quotes. By speaking to them, you can gauge what kind of business they are and ask about availability and report writing timescales. Always ensure they are a member of the Institute of Chartered Surveyors.

Within the week or so you will usually receive a survey report, which will include a breakdown of the property and the cost to rebuild the property. There may be areas that you don’t understand in the report. One tip is to consult an expert in the field if you need further guidance. For example, if something is identified on the roof, speak to a roofer for a second opinion.

The report should have a traffic light system so it is easy to understand how urgent issues are.

If you are buying a house and the survey brings back issues you are concerned with it is possible to negotiate with the seller on these things. Suggestions for resolution could include a request for work to be done, an agreement on a price reduction, or an agreement for either you or the seller to commission a specialist survey to look into the issue further. One thing you might want to do is consult a specialist before being scared off by a problem.

For example, a surveyor may provide a detailed report which lists several issues with the roof, which may scare a potential buyer off due to the cost of a new roof, yet a roofer may take a look and conclude that several small jobs will rectify the issue.

Typically yes, but surveys are generally based on the property price, with London having the highest property prices. That’s not to say you can’t get a good deal if you shop around and get several quotes.

From the point of booking a house survey, it should only take a few days but will depend on the caseload of the surveyor and the ability to access the property. The survey itself should take no more than a couple of hours and a home report should be drafted within one to two weeks.

A full structural survey will look at the structure of the property and its stability. This type of survey is a good idea when the property is old, in poor condition, or if subsidence is suspected.

A full structural survey costs upwards of £700, depending on the value of the property.

A surveyor shouldn’t look inside a cupboard without reason. Your house surveyor will examine the outside of the property from ground level, looking at things like the chimney, roof, gutters, walls, windows, doors, conservatories, and porches. Inside, they will assess the roof, ceilings, walls, partitions, uncovered floors, fireplaces, chimney breasts and flues, staircases, woodwork, and bathroom fittings.

A house can’t fail a survey, but it can be marked down on the condition ratings, which may influence what you consider the property to be worth. Common problems raised on a survey include asbestos, subsidence, damp, Japanese knotweed, electrical issues, drain issues, roof issues, insulation, and ventilation.

A survey is not a requirement to buy a home, but it does give you peace of mind that you won’t get any unwanted and expensive surprises when you get those keys. If any issues arise, a survey is also your documentation to evidence any negotiation on price. For more information on all the costs associated with buying a house, check out our step-by-step guide to buying a house.

If you need to find a surveyor near you please take a look at the Propertyable Surveyor Directory today.

From mortgages and insurance to viewings, offers, exchange and completion, our Buyers’ Guide will take you through everything, step by step, from start to finish.

© Copyright Propertyable 2026. All rights reserved.